App Store Screenshot Dimensions & Guidelines

Posted on August 1st, 2024

Make sure your app stays compliant with the latest App Store Screenshot Dimensions & Guidelines here

Where developers drive the bulk of their app marketing focus will determine how their app (or apps) will perform. But what happens when developers decide to consolidate two different services? How does prioritizing one over another affect operating costs, app store performance, and future ASO strategies? That's what we'll analyze below in this ASO Academy.

Shifting the focus from two different apps to one can be a way companies can make efficient use of existing resources. For example, if a recent acquisition isn’t garnering the expected contribution to a company’s bottom line, consolidating it into another existing product in their portfolio can help lower costs and allocate resources towards a service producing a higher ROI.

Even if an app fulfills a particular audience segment that may be lost because of the consolidation, the costs to keep the service – from basic maintenance to performing regular App Store Optimization, may not be justified for the revenue it generates.

Depending on the type of service the two apps offer, consolidating them into one can help merge two user bases otherwise separated by the different experiences. Housing users on one platform can help to streamline app marketing initiatives focusing on a broader audience, directing them towards one app, and simplifying retargeting measures as a whole.

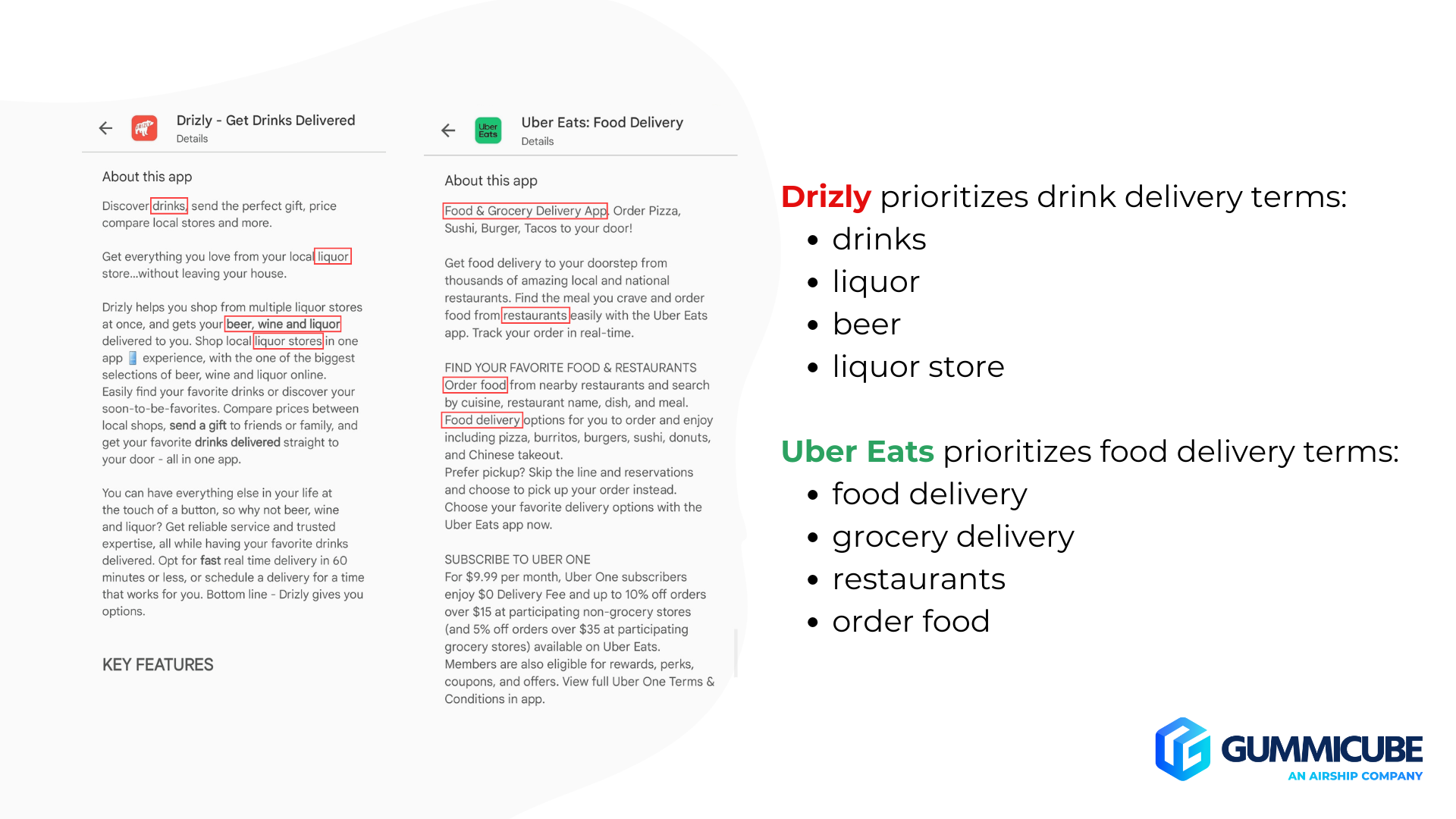

Uber’s recent Drizly announcement exemplifies how a company can decide to focus its efforts on their larger service as a whole, rather than more niche segments. Additionally, Uber Eats also offers alcohol delivery, providing an alternative for existing Drizly users.

Although Uber Eats’ platform is much broader in its product offering, its developers can target user segments towards specific beverage options found on their app to continue catering specifically to those interested in alcohol delivery. For example, a mobile deep linking strategy where a URL is published on a social media post can lead users to a specific page on the app that focuses on alcohol delivery. Another strategy would be to use Custom Product Pages to create an App Store experience specific to those interested in alcohol delivery.

This approach can help Uber Eats penetrate a very specific niche within food delivery, leveraging the power of native app marketing tools.

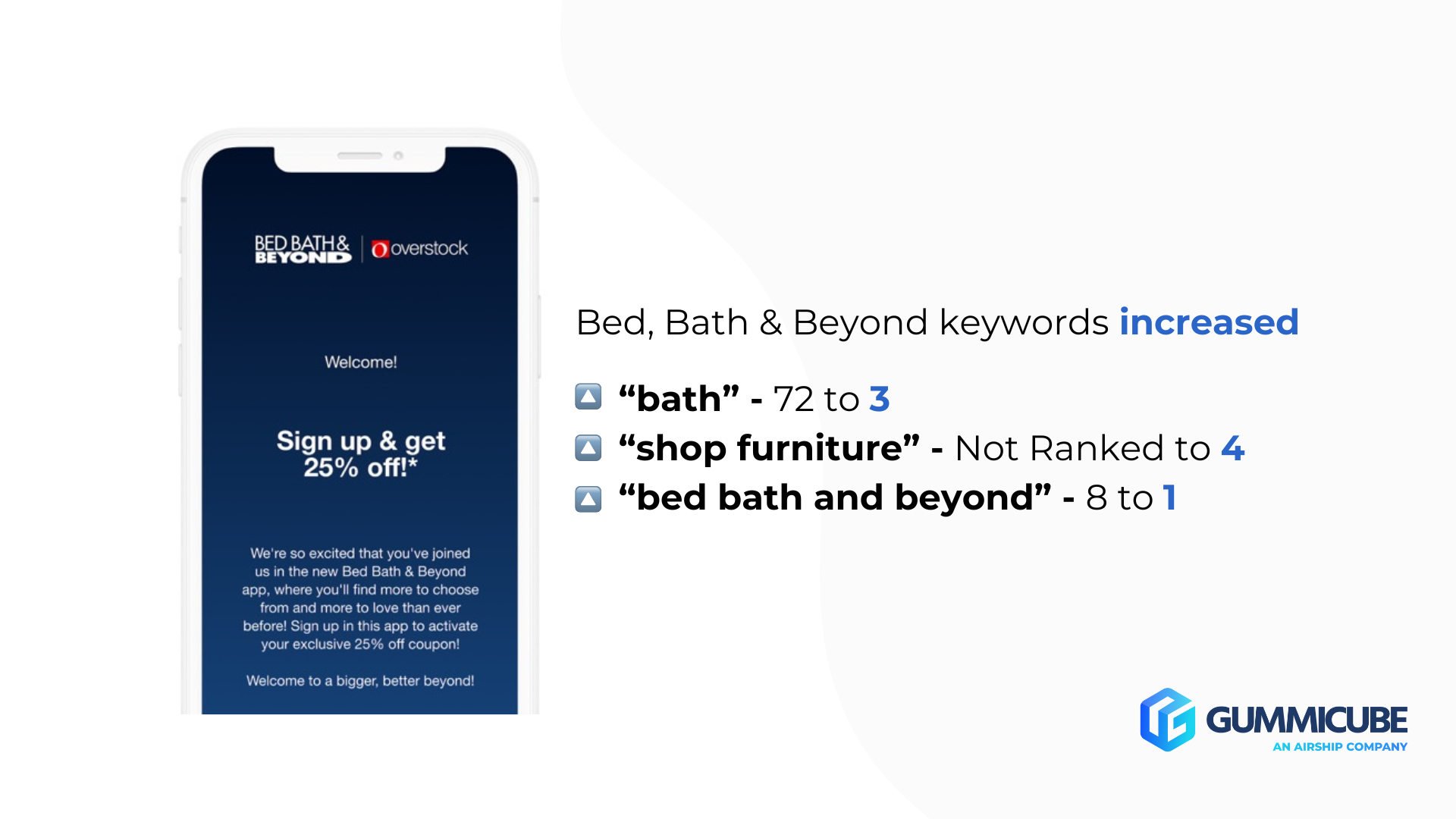

What if an app could use a boost? An company whose app store presence or performance is lackluster can benefit greatly from another app – even if the one helping is… dead? The case in question is Overstock’s recent app overhaul leveraging the name and likeness of Bed, Bath & Beyond.

When the retail chain was acquired by Overstock, it rebranded as Bed, Bath & Beyond, taking the company’s traditionally brick and mortar stores and going completely digital. This saw Overstock leveraging the Bed, Bath & Beyond’s decades-long brand awareness, consumer loyalty, and ASO performance changes that came as a result.

Merging one app with another doesn’t guarantee the previous app store success of the defunct one will transfer over. If an app was performing well at the time of shutting down, the acquiring app’s developers will have to study how they can combine their existing ASO strategy with the new one.

If we take the example of Drizly again, we can see that their current ASO strategy focuses on drink delivery, exemplified by the keywords prioritized in their Google Play app description. However, if we take a look at Uber Eats, the keywords in their description varies greatly, focusing more on food and a wider selection of goods resonating with their audience. Because each brand’s mobile app keyword strategy targets two different audiences, Uber Eats must decide between the lesser of two evils – possibly lose ranking in core terms to incorporate drink and alcohol delivery keywords or lose considerable market share to competitors whose ASO strategy gives importance to drink and alcohol delivery keywords.

The latter option is a very real scenario for developers whose users don’t see themselves transferring over to the larger, acquiring app. This can be exacerbated if the company itself makes little effort to make the onboarding process towards the new app easy for potential users.

An example of this is the news and consequences of the personal finance app, Mint shutting down. When announced, competitors were quick to launch campaigns across social media and Google search to try and attract new users towards their apps that provided similar services to Mint. Although the app’s closure has been delayed, that didn’t stop users from flocking towards apps like Monarch Money and Cheddar, with the former’s CEO stating the brand saw twice the number of users singing up after the announcement.

The reasoning behind Mint ceasing operations was to focus on the broader Credit Karma app, whose offering is similar and has a much larger user base. However, no matter how much bigger Credit Karma might be, the impact of Mint users forgoing the acquiring platform in favor of competitors stings. To remedy this, developers should prepare an effective onboarding process for users of the closing app, coupled with an app marketing strategy targeting them specifically and noting the similarities between both platforms.

Before merging two apps or completely revamping your ASO strategy to attract a new segment of users, ask yourself the following questions:

There are a plethora of considerations when looking to consolidate app store marketing efforts. Arm yourself with the resources necessary to make your users transition as seamless as possible and be able to adapt your App Store Optimization plan.

Don’t do it alone! Get in touch with our ASO company today for guidance at every step.

Make sure your app stays compliant with the latest App Store Screenshot Dimensions & Guidelines here

Soon developers will be able to extend their customer lifetime value with a handy new way of providing subscription offers directly through Apple. Contingent Pricing looks to act as a revolutionary new system for leveraging new upsell & cross-sell opportunities all within Apple’s ecosystem.

Have you ever A/B tested your Google Play listing? If not, you're probably navigating the Play Store marketing blind, and leaving valuable installs on the table.